5 hours ago

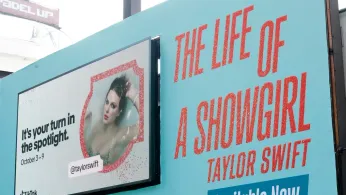

Taylor Swift's 'The Life of a Showgirl' Breaks Record, Sells 2.7 Million Copies in U.S. on First Day

Maria Sherman READ TIME: 2 MIN.

It's the life of a saleswoman. Taylor Swift's 12th studio album, “The Life of a Showgirl,” sold 2.7 million copies in traditional album sales — which include physical and digital formats — in its first day in the U.S. That's according to Luminate, an industry data and analytics company.

The album was released Friday.

The sales are impressive for a number of reasons. Swift has broken her record for most first week sales... in one day. Her last album, 2024's “The Tortured Poets Department,” amassed 2.61 million equivalent album units in the U.S. in its first week.

“The Life of a Showgirl” has also become the second-largest sales week for any album in the modern era, since Luminate began tracking sales in 1991. That was also accomplished in just one day.

Currently, Adele's “25,” which sold 3.378 million copies in its first week in 2015 in the U.S., holds the top spot.

Also, according to Luminate, “The Life of a Showgirl” has already broken the record for the most copies of a vinyl album sold in a single week in the U.S., with 1.2 million copies. The previous record holder? “The Tortured Poets Department,” which sold 859,000 copies on vinyl in its first week.

Swift's many variants may have something to do with the album's economic success. One of her major partners, Target, carries three CD variants, titled as “It’s Frightening,” “It’s Rapturous” and “It’s Beautiful” editions. There is also an exclusive vinyl release, “The Crowd Is Your King” edition in “summertime spritz pink shimmer vinyl.”

There are a number of other vinyl variants as well: “The Tiny Bubble in Champagne Collection,” “The Baby That’s Show Business Collection,” “The Shiny Bug Collection,” and the standard LP and cassette, in “sweat and vanilla perfume Portofino orange vinyl.”

Artwork varies throughout, likely inspiring diehard fans to pick up multiple copies.

And most recently, on Saturday, Swift announced four new CD variants featuring acoustic renditions of the album's tracks. Each edition features two different stripped-down recordings.

She also dominated the box office over the weekend with her three-day event, “The Official Release Party of a Show Girl,” which debuted at No. 1 with $33 million in North America, according to Sunday estimates from Comscore.